Employee Provident Fund

The Provident Fund is a welfare scheme for the benefits of the employees. Both employer and employee contribute their share of the amount, but the whole of the amount is deposited by the employer. The employer deducts the employee share from the salary of the employee. So, the accumulated amount can be withdrawn if certain conditions are met. Employees Provident Fund was established in the year 1952.

Scheme Functioning

Under the EPF scheme, employers and employees both contribute to the EPF account every month. However, it is the responsibility of the employer to deposit the entire amount in the EPF account. The employee’s EPF share is deducted from their monthly salary.

For all EPF transfers, an employee needs to have a UAN(Universal Account Number), which is issued by EPFO. The UAN is allotted to an individual under which an employer makes all necessary payments. Its mandatory to have Aadhar linked with UAN, else no payments are possible.

Applicability of the EPF Act

It is mandatory for all organizations that have employed a minimum of 20 employees. Within one month of attaining the employee strength, an employer has to register with EPF.

If when employee strength of a registered establishment falls below 20, the act is applicable. Once a firm is registered, the EPF act will be active irrespective of employee strength

Organizations with less than 20 employees can also avail of voluntary registration. All the employees from the beginning of their employment will be eligible for EPF.

EPF Objectives

- To ensure every employee has only one EPF account.

- Compliance must be facilitated easily.

- Make sure organisations follow all the rules and regulations set up by the EPFO on a regular basis.

- To ensure that online services are reliable and to make improvements in their facilities.

- For all member accounts to be accessed online easily.

- Claim settlements to be reduced from 20 days to 3 days.

- Promotion and encouragement of voluntary compliance.

Universal Account Number (UAN)

All subscribers of EPF can access their PF accounts online and perform functions like withdrawal and checking EPF balance. The Universal Account Number (UAN) makes it convenient to login to the EPFO member portal.

The UAN is a 12-digit number alloted to each member by EPFO. The UAN of an employee remains the same even after he/she switches jobs. In the event of a job change, the member ID changes, and the new ID will be linked to the UAN. However, employees must activate their UAN in order to avail the services online.

You can get your UAN through your employer. In case you are unable to do so, you can easily login to the UAN portal with your member ID and find the UAN.

EPF Deduction

Contribution by an employer

13% of the eligible salary of the employee. Its is subdivided into

- Employee Pension Scheme (EPS) – 8.33%

- Employee’s Provident Fund (EPF) – 3.67%

- EDLI - 0.5%

- PF Admin Charges - 1%

Contribution by an employee

12% of the basic salary of the employee. This amount is deducted from the salary of the employee

Eligible Salary

The following components of the salary will be considered for EPF calculations

- Basic

- VDA

- Any other Fixed Component*

If Salary paid is less than Rs.15000, then both the employer and employee contribution will be as shown above.

If the amount exceeds Rs.15,000 then employee has the an option to either contribute based on the original amount or restrict the calculations to Rs. 15,000 or choose not to contribute to the scheme.

For an employee with a monthly salary less than or equal to 15000 will have to contribute mandatory towards EPF.

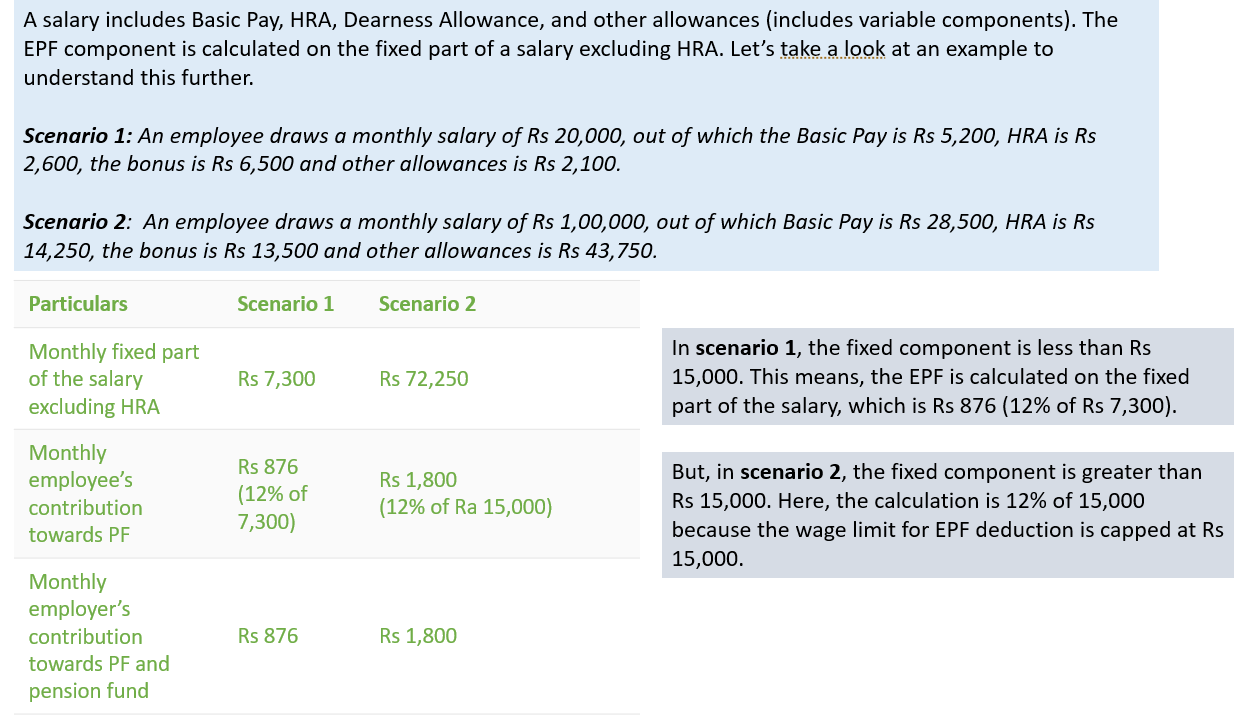

A sample caclcultion is shown below for reference

EPF Sample Calcution

It is important to keep note that An employee can contribute more than 12% of Rs 15,000 if they wish to do so. However, there is no obligation that the employer has to match the employee’s contribution and can choose to cap their contribution at 15,000.

EPF Benefits

- Assists People in saving money for the long run.

- Easy Monthly deductions help build a saving habit that permits a person to save a huge amount of money over a long period. ^ It aids employee financially during an emergency.

- It assists employee to save money for retirement and helps an individual maintain a good lifestyle.