Employee State Insurance

Employee State Insurance Scheme is a cover meant for the workers and employees to ensure and protect them with medical care.

ESI offers various cash and medical benefits to industrial employees and workers in case of sickness, maternity, or employment injury. The scheme also covers pension to the family members in case of death or injury of the insured person.

ESI is one of the vital payroll compliances that an organisation must fulfil in India.

Eligibility

The Employee State Insurance scheme applies to,

- An organization with more than ten employees and those employed in the non-seasonal factory are eligible for the EIS scheme. This criterion is applicable under Section 2(12) of the Act.

- An individual earning Rs.21000 will be covered under the EIS scheme with effect from January 1, 2017.

The following components of the salary will be considered for ESI calculations when determining eligibility of an individual for ESI

Basic

HRA

VDA

Allowances

- Uniform Allowance

- City Allowance

- Meal Allowance

- Incentives

- Any other Special Allowance

Conveyance Allowances

The Supreme Court has passed an order (dated 8 March 2021) stating that conveyance allowance or travel allowance does not fall under the definition of ESI wages. When calculating wages for ESI, conveyance allowance is not considered

Key Features and Benefits of ESI

There are a number of attractive features and benefits that are offered by the Employee State Insurance Corporation. Not only does it provide medical benefits but it also comes with a level of financial security in times of financial hardship like unemployment, etc. Some of these are listed below:

- Medical Benefits: The Employee State Insurance Corporation takes care of an individual’s medical expenses by providing reasonable medical care. This cover comes into effect from day one of the individual’s employment.

- Disability Benefit: In case an employee is disabled, ESIC ensures that the employee is paid their monthly wages for the period of the injury in case of a temporary disablement or for the remainder of the employee’s life in case of a permanent disablement.

- Maternity Benefit: ESIC helps an employee welcome their baby to a household which has been showered with benefits. ESIC provides a total of 100% of the average daily wages for a period of to 26 weeks from the time of going into labor and 6 weeks in case of a miscarriage. 12 weeks of pay is provided in the case of an adoption.

- Sickness Benefit: ESIC ensures that there is a flow of cash coming into the employee’s household during medical leave. 70% of the average daily wages of an employee is paid during medical leave for a maximum period of 91 days in two successive benefit periods.

- Unemployment Allowance: ESI provides a monthly cash allowance for a maximum period of 24 months in case of permanent invalidity due to a non-employment injury or due to involuntary loss of employment.

- Dependent’s Benefit: In case the employee meets with an untimely death due to an injury at the place of employment, ESIC will provide monthly payments apportioned among the surviving dependents.

- Confinement Expenses

- Funeral Expenses

- Physical Rehabilitation

- Vocational Training

- Skill Upgrade Training under Rajiv Gandhi Shramik Kalyan Yojana (RGSKY)

ESI Contribution Rates

Contribution by an employer

3.25% of the eligible salary of the employee

Contribution by an employee

0.75% of the eligible salary of the employee

Due Dates for The ESI Payment and Return Filing

Every month, the employer shall pay their contributions and the employee’s contribution to the ESIC. The due date for ESI filing contribution is the 15th of the following month.

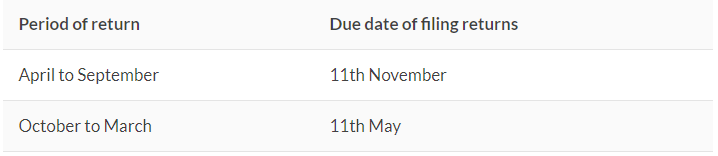

The employer also needs to file an ESI return on a half-yearly basis. Below mentioned are the due dates

To know more, please click here