Understanding Income Tax

Tax is a mandatory fee levied on individuals or corporations by the government. The money collected is used to finance government activities. Income Taxes are levied on the earnings/incomes of organizations or individuals by the government. These earnings can be from different sources such as Salary, Interest, Investment Proceeds, Business Profit, rent etc

Each Country has their own rules and charges for the Taxes charged under Income Tax

Income Tax In India

In India, tax levied on income is applicable at incremental rates as per income tax bracket. This means that lower-income is taxed at a lower rate (including nil rate) and higher-income has a higher income tax bracket rate.

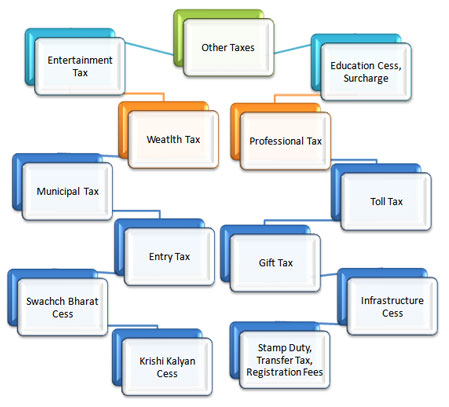

Tax Types

Direct Tax: Tax Paid Directly on your Income to the Government

Indirect Tax: Tax an entity collects on one’s behalf and pays to the government. Eg. restaurants, movie theatres, massage parlors, etc. In India, GST, VAT, Excise Duty are most common indirect taxes that one pays

Tax Payments

The money from taxes is collected by the Income Tax Department of India via Tax Deducted at Source (TDS), Tax Collected at Source (TCS), and voluntary payment by taxpayers.

TDS - Tax that is collected at the same time as the income is generated. This is applicable to incomes such as salaries, interest, commissions and, dividends.

TCS - Tax that is payable by the seller, but it is collected from the buyer. Most Indirect Taxes are collected in this manner

Voluntary Payment - Taxes Paid by the Individual or Organisation at their own discretion

Tax Liability

- Individuals, Association of Persons (AOP), Hindu Undivided Family (HUF), and Body of Individuals (BOI)

- Firms

- Companies / Organizations

Each of these taxpayers is taxed in different ways under the Indian income tax laws. Firms and companies have a fixed rate of tax - 30% of profits. The individuals, AOP, HUF, and BOI taxpayers are taxed according to the income tax bracket they fall in.

Income Sources

Slary: Salaried individuals and pensioners

Other sources: Interest earned from savings accounts, fixed deposits etx

Residential properties: Income earned from rent or from the sale of a property

Capital Gains: Income earned from the sale of capital assets such as mutual funds, shares, land, building etc

Business or Self-employment: Income earned from freelancing, contracting, consulting, legal practice, medical practice